Summary:

In the United States, California has dominated the solar power market, however, Texas is making gains in the utility-scale solar panel installation department, so much so that Texas is expected to beat-out California in 2020.

Main Article:

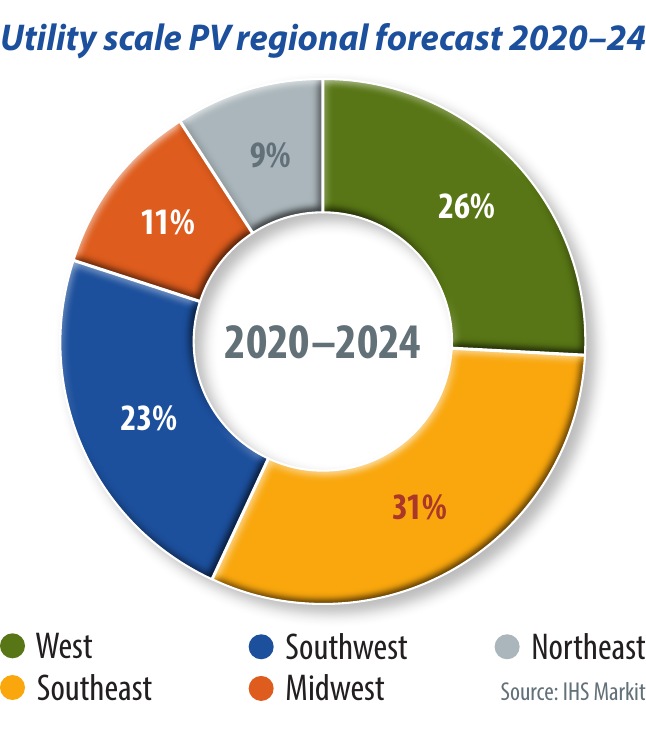

In the southern United States, solar panel installations have surged, mainly through utility-driven demand. IHS Markit forecasts that the southeastern and southwestern parts of the country will account for 31% and 23% of total utility-scale demand from 2020 through 2024, respectively. Opportunities for large utility-scale solar panel installation in the south are vast, given the region’s strong solar energy resource and the availability of land. During the 2020–24 period, demand will continue to come from large procurement programs directed by utilities, along with demand generated by the Public Utility Regulatory Policies Act (PURPA) mechanisms in states like North and South Carolina.

In 2020, utility-scale solar power growth in the southeastern U.S. market will be led by Florida and Virginia, with each state set to install more than 1 GW in 2020. Growth in the southwestern market, meanwhile, will be dominated by Texas, which is forecast to install a record 3 GW of solar power this year.

Texas vs. California

Texas established a voluntary goal in 1999 of 10 GW of renewable energy generation by 2025. The state was able to exceed that goal in 2009 due to the large number of wind energy projects put online. Like many southern states, Texas does not have a statewide policy to promote solar power. Historically, demand for solar panels has stemmed from the state’s two large public utilities, Austin Energy and CPS Energy, both of whom have mandated RPS goals. This has changed in the past few years, with large solar energy developers spearheading the development of massive utility-scale solar power plants.

As the installed base of solar panels has grown in Texas, a flurry of investors has become active in the market. At the end of July 2020, Japanese utility Tokyo Gas announced its acquisition of a 631 MW solar farm in Texas. It is expected to come online in 2021. At the beginning of August, J-Power and AP Solar said they had entered into a joint venture to develop a 400 MWac project in the state, with an expected completion date in 2023. Recently, state utility CPS Energy said it would seek to install 1 GW of solar power to bring it closer to its 50% by 2040 goal. Financial closings have also been taking place during Covid-19, with Recurrent Energy securing funding in July for its 327 MW plant in west Texas, which will deliver power to beer brewing giant Anheuser-Busch under a power purchase agreement.

Declining solar power system costs, the state’s deregulated electricity market, a streamlined permitting and connection process, transmission lines designed to handle renewable energy, and vast amounts of land and strong solar energy resources have made Texas an ideal place for solar power to flourish.

Construction has continued to move forward throughout the state since lockdown measures began in March, as it was quickly deemed an essential service. Although a handful of projects have reported delays due to Covid-19, most of the Texas solar power pipeline is expected to be completed this year. IHS Markit expects utility-scale solar panel installation projects in Texas to account for 96% of large-scale solar panel installations in 2020, totaling 3 GW. By contrast, California is expected to install more than 2 GW of utility-scale solar energy projects in 2020.

Industry strength

The resiliency of U.S. solar power lies not only in federal and state policy. The industry’s strength is also due to decreasing capex costs, attractive wholesale power prices, and voluntary cost-competitive procurement by utilities that have further encouraged the growth of solar energy in the country.

IHS Markit estimates that by the end of July 2020, the United States had installed nearly 6 GW of large-scale solar panel installations – four more than was installed by July of last year. More than 6.5 GW of projects are under construction, all expected to be completed this year. However, the strength of this segment has not translated to residential and commercial solar panel installations. Distributed solar power in the United States is expected to be impacted the most by Covid-19 due to its in-person sales approach. Many individuals and businesses will also push out making long-term investments in solar power due to the uncertain economic environment.

The solar power market in the United States has not only had to face the challenges brought by Covid-19, but also protectionist policies that have increased tariffs on virtually all components that make up a solar power system. For example, in the second quarter, the average sales price of a monofacial PERC solar panel in the U.S. solar energy market stood at $0.35/W, while the price outside the country fell to $0.23/W. Notwithstanding the premium in the U.S. market, the country is still one of the leading solar markets in the world, with cumulative solar panel installations surpassing 76 GW to date.

Corporate procurement

While the Investment Tax Credit (ITC) has been an important incentive for tax equity investors to finance renewable energy, investor-owned and public utilities have seen the opportunity and cost advantages of solar. Through Integrated Resource Plans (IRPs) and Request for Proposals (RFPs), many states have maintained a robust solar energy pipeline. Solar power is also attractive to investors in search of low-risk and stable-yield opportunities.

Utilities across the country have set varying goals through 2050, indicating that solar panel installation will continue to grow even as the ITC steps down in 2024. For example, Duke Energy Corp. is seeking to reduce its carbon emissions at least 50% by 2030, while Xcel Energy is aiming to reduce company-wide emissions by 80% by 2030. Dominion Energy hopes to achieve 100% net zero greenhouse gas emissions by 2050, and in its latest IRP, the utility is looking to add 7- 19 GW of solar power in the next 15 years.

Corporations have also helped the expansion of large-scale solar panel installation in the United States. At the end of 2019, Google announced it was partnering with AES Corp. to push renewable energy projects forward in the United States. Recently in its latest RFP, AES is seeking to award contracts for up to 1 GW of new renewable power. Similarly, Facebook and Rocky Mountain Power announced they would work together to build nearly 700 MW of solar projects in Utah.

The impetus of the utility-scale solar power market in Texas and across the United States proves that the appetite for solar panels remains strong in the near term. According to IHS Markit’s Solar Deal Tracker, the United States overall is estimated to have a utility-scale solar panel installation development pipeline of over 85 GW from 2020 through 2024.

Get creative and design your own rooftop solar system by going to HahaSmart and using the design DIY tool and see how much the system will cost using the price checker tool.

Input your address to see if it is solar friendly and how much you can save with solar.

Great. Your address is perfect for solar. Solar incentive is still available. Select monthly utility cost and calculate the size of solar system you will need now.

| kw System size | years Payback period | Lifetime savings |

No money down, 100% finance is available.

|

|

Interested in Getting a Solar Panel Installation? Sign Up Here! |

Comments