Summary:

SunPower posted a strong quarter for the last quarter of 2019. The profitable quarter capped off a profitable year for the solar company. The favorable quarter was driven by record solar panel shipments, which ended up being ahead of projections.

Main Article:

Since announcing that SunPower’s high-efficiency solar cell manufacturing business would be spun off into its own solar company, CEO Tom Werner has referred to the remaining solar company as “the new SunPower” – and that idea looks to be more than just a change in mindset, as the solar company posted a rare profitable quarter in the three months to the end of December 2019, capping off an even larger rarity: a profitable year.

The solar company posted a net income of $5.4 million to close the fourth quarter, marking a considerable quarter-over-quarter and year-over-year improvement, as it finished with losses of $15 million in the July-September period and $158.2 million in the final three months of 2018. On the whole, SunPower finished 2019 with a net income of $22.2 million – a much different story than 2018, when it finished $811.1 million in the red.

On top of this profit, SunPower finished 2019 with $420 million in cash and plans to pay off more than $30 million of debt in the first quarter of this year.

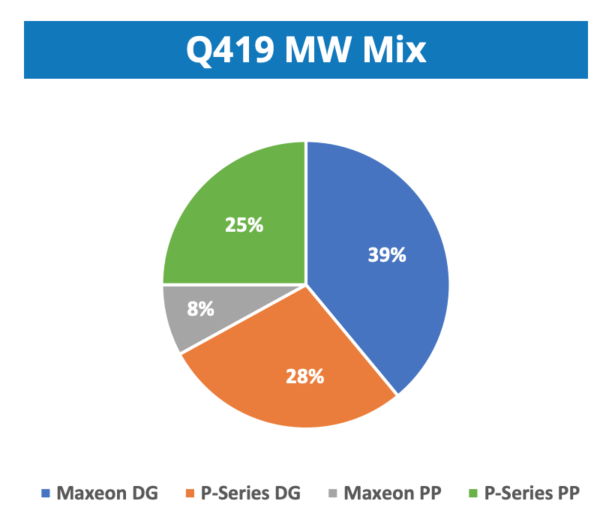

The favorable quarter was driven by record shipments, which ended up being ahead of projections. Broken down, the company shipped 536 MW of solar modules for distributed generation solar panel installation projects, up 95% from 2018, and 256 MW for larger-scale solar panel installation projects. Of the 792 MW shipped, 420 MW came from the solar company’s P-Series shingled solar modules.

While the P-Series accounted for 53% of all solar panel shipments in the fourth quarter, the Maxeon solar module actually shipped more than the P-Series in the distributed generation sphere, accounting for 39% off all shipments in the quarter.

In total, the solar company shipped 2.5 GW of solar panels in 2019, representing 80% growth over 2018. While this still leaves the company about 1.5 GW away from a spot on the top 10 list for solar panels shipped in 2019, it’s greater growth than all but one solar company on that list (First Solar).

In terms of what these numbers mean for solar panel installation figures, the solar company added more than 12,000 residential solar power customers in the fourth quarter, bringing its total number of residential solar power customers above 305,000. The solar company also sold 27% more MW of residential solar power than in the third quarter. On the storage side, SunPower built up its solar power project pipeline to more than 175 MW, headlined by a 20 MWh storage project from Chevron.

Now that SunPower has posted a strong fourth quarter and a profitable year, the next challenge will be sustaining this success while building up the new Maxeon Solar Technologies. That solar company is supported by a $298 million investment from Tianjin Zhonghuan Semiconductor, one of the world’s largest silicon wafer makers, and the spinoff is a move that Werner believes is the key to unlocking long-term shareholder value.

If you’re interested in going solar, see how much you can save by using the HahaSmart price checker tool and you can design your own solar-powered system using the design DIY tool.

Input your address to see if it is solar friendly and how much you can save with solar.

Great. Your address is perfect for solar. Solar incentive is still available. Select monthly utility cost and calculate the size of solar system you will need now.

| kw System size | years Payback period | Lifetime savings |

No money down, 100% finance is available.

|

|

Go Solar Today and Sign Up Here! |

Comments