Summary:

SunPower Corp. is predicting losses in the hundred-million-US-dollar range, even though it came back to profitability in 2019, right after it was moved to spin off its solar panel manufacturing business.

Main Article:

SunPower Corp. is expecting losses in the hundred-million-US-dollar region this year despite its comeback to profitability in 2019, a year when it moved to spin off its solar panel manufacturing business.

This week, shares of the Nasdaq-listed US solar energy corporation rose and then dipped as it emerged the firm is now forecasting GAAP net losses of US$145-195 million for the fiscal year 2020. In Q1 2020 alone, the predicted net losses could reach US$70-85 million.

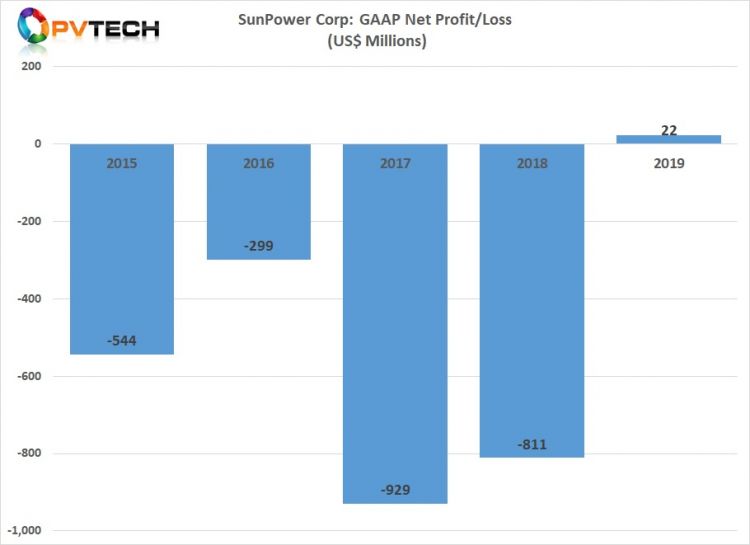

SunPower’s expectations of a 2020 downturn come despite its return to profitability in 2019, evidenced in the financial results out Wednesday. After sweeping GAAP net losses in 2015, 2016, 2017 and 2018 (see chart below), the firm was back in the black in 2019, at a positive US$22.2 million.

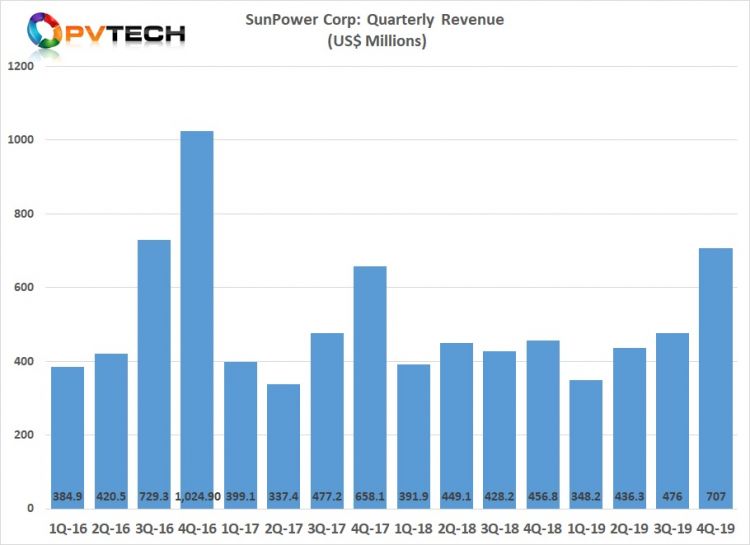

Last year’s profitability comeback came as SunPower reported a GAAP revenue boost between 2018 (US$1.72 billion) and 2019 (US$1.86 billion). On Wednesday, the firm claimed it ended last year with US$423 million in cash reserves, up from US$309 million at the end of 2018.

The bumps to revenue and cash were accompanied, however, by swelling volumes of debt. SunPower’s records show it finished 2019 with US$105 million in short-term debt and US$113 million in long-term debt, where either indicator stood at around US$40 million the year prior.

On a conference call, SunPower CEO Tom Werner said the firm expected a “minimal impact” from the coronavirus crisis on its Q1 2020 figures. The executive – who said the firm is working with its partners to “mitigate” the disruption – was later asked by analysts to spell out what the effects could be.

As he answered, Werner acknowledged that logistics are currently “challenged” in China, creating “shortages”. He said however that if current “positive signs” – such as factories coming back online – continue, SunPower “expect to manage through this and hold guidance as we guided today.”

The talk of supply chain disruption from the global virus epidemic emerges three months after SunPower said it would spin off its solar panel manufacturing operations, now set to be transferred to a new listed entity – Maxeon Solar – backed by China’s TZS as a minority shareholder.

As it released its results this week, SunPower said its refocusing on downstream DG solar power work after the split last year has played out well, with revenue and roll-out records with residential solar power systems in 2019 and a backlog of 45,000 homes.

The picture last year was bleaker for SunPower’s Commercial Direct business, however. The unit servicing government and corporate players achieved “strong” origination numbers but faced, in turn, challenges around project execution, leading to “underperformance” overall.

Noting that project execution is currently “not working great,” CEO Werner told analysts: “We had an unusual number of projects that were delayed by virtue of permits or interconnection issues. And then any time there's a delay that means we have fixed costs that are under absorbed.”

According to the executive, SunPower’s plan to take its Commercial Direct back to profitability in H2 2020 will include subcontracting larger construction volumes to external EPC firms, changes to leadership and ensuring bookings are focused on “margin rather than volume”.

Get creative and design your own rooftop solar system by going to HahaSmart and using the design DIY tool and see how much the system will cost using the price checker tool.

Input your address to see if it is solar friendly and how much you can save with solar.

Great. Your address is perfect for solar. Solar incentive is still available. Select monthly utility cost and calculate the size of solar system you will need now.

| kw System size | years Payback period | Lifetime savings |

No money down, 100% finance is available.

|

|

Want to Get a Solar Panel Installation for Your Business? Sign Up Here! |

Comments